Just as the name suggests, a gold investment is any transaction in which you invest in order to receive gold in return. Today, we’re going to explain a little about the history surrounding gold investments along with how you can get started, the benefits of gold investments, and the future of gold in the wider market.

History of Gold Investment

When people ask the question ‘what is gold investment?’, it pays to look back at the history. First found in 3,000BC when the Egyptians started to use the precious metal for jewelry, it took 2,500 years before it was used as currency. Since merchants needed a single currency for trading, stamped gold coins seemed to be the most acceptable solution since gold jewelry had already reached all four corners of the world.

In 1066, Great Britain followed the lead of the Greek and Roman empires by developing a metals-based currency and the first proper currency system was born with the British pound, shilling, and pence. Towards the 1900s, the Federal Reserve in the US began to print promissory notes which went on to become paper money and replaced gold coins. Although it has no role in currency now, gold still plays a pivotal role around the world.

Gold in Modern Society

Rather than being available to the average Joe on the street, gold is now important in the global economy. If we look at the central banks and international organizations around the world, we find 20% of the world’s supply of all gold. With economies becoming more futile, more central banks are choosing to invest into gold.

Gold is a Safe Haven

For many years, people were content to deal in currencies and exchange within these markets. Even for those saving for retirement, the sensible option seemed to be relying on stocks and bonds, the strength of the US dollar, and our whole economy. However, recent years have destroyed the confidence we once had. Even with trouble in the Middle East, Africa, or anywhere else in the world, it’s not hard to see that economic uncertainty is common within a modern economic environment.

For many years, people were content to deal in currencies and exchange within these markets. Even for those saving for retirement, the sensible option seemed to be relying on stocks and bonds, the strength of the US dollar, and our whole economy. However, recent years have destroyed the confidence we once had. Even with trouble in the Middle East, Africa, or anywhere else in the world, it’s not hard to see that economic uncertainty is common within a modern economic environment.

With the global crisis in 2007/08, this was the final straw because very few economies escaped unharmed. Even the countries with the longest and strongest history of economic performance, they struggled and investors lost billions of dollars. Therefore, the attention turned to gold and it looks as though it’s going to stay this way for some time to come.

During times of collapsing currencies, collapsing empires, and the changes in political groups, gold has certainly been affected but it’ll never be impacted to the extent of an economy. For investors who hold gold during these tough times, they protect their wealth and free themselves from the dwindling environment around them. Both now and long into the future, gold is and will be seen as a safe haven.

Why is Gold Protected?

When you invest in the stocks, bonds, or even real estate, your results are directly tied to the performance of the economy and the country on a global scale. With gold, this will always be seen as a precious metal because it’s a scarce resource. Thanks to simple supply and demand, we know that scarce resources demand a certain value (this is the value at which gold should never fall below). While stocks and shares have no floor and can continue plummeting for months and years, gold has a minimum value.

What is Gold Investment?

With the benefits explained, gold isn’t linked to stocks, bonds, or real estate and it maintains a value by itself. If you have an investment portfolio or perhaps there’s a retirement fund in play, now could be the time to diversify and choose gold. With retirement especially, there are some superb options to achieve this including Regal Assets. With a simple transaction, your retirement fund becomes a gold IRA and you can stay protected against the fluctuations of the economy.

How to Own Gold

Often, ‘what is gold investment?’ is a question referring to the many ways one can own gold. Rather than imagining a huge truck turning up at your door delivering crates of gold, there are actually several ways of investing in the precious metal and it’s worth talking to a finance expert if you’re unsure of anything.

As an investor, you need to look out for gold coins, gold mutual funds, gold jewelry, gold bullion, gold futures, gold companies, gold ETFs, and more. Depending on which solution you choose, there’s going to be certain advantages and disadvantages so investigate the options and find one that matches your investment strategy.

Benefits of Gold Investment

Hedging Against a Down Market – As we saw shortly after the global crisis, everybody started to invest in gold when the market took a tumble and this increased the value of the precious metal. For those who had been invested in gold for some time, they saw the value of their portfolio rise significantly. In fact, some sold when demand was at its highest point before then reinvesting when the prices resumed a normal price (gaining thousands, hundreds of thousands, and even millions in the process). With your investment, you can hedge against a weak market.

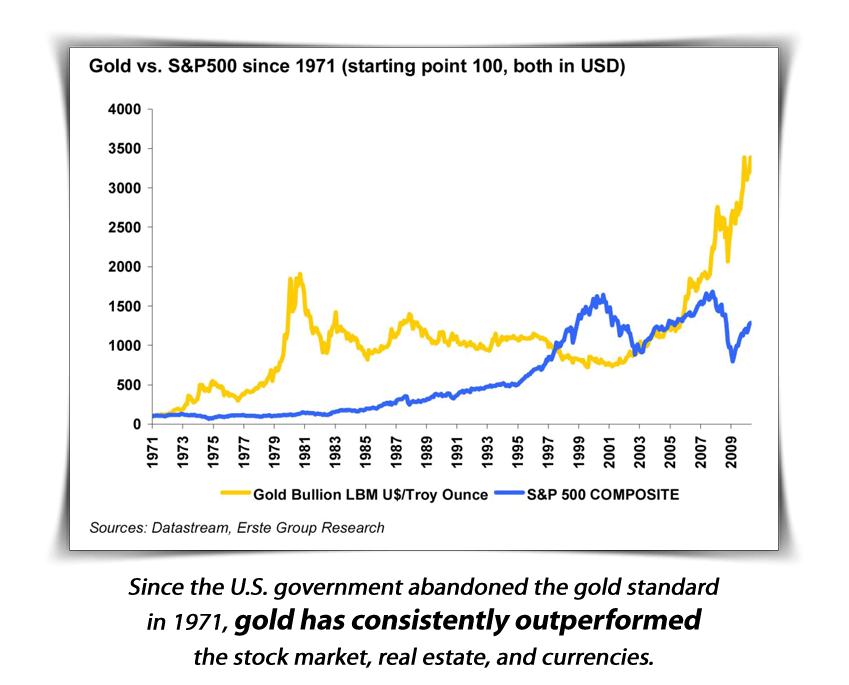

Gold Outperforms Stock Market – While gold has had ups and downs, and stagnation at times, the fact remains that since the U.S. Governement abandoned the gold standard in 1971, gold has consistently outperformed the stock market, real estate and currencies

Security – With so much uncertainty in the world, we all need a little security and this is what gold provides. Although it might not gain much in value (except during a downturn in the economy), you know the investments aren’t ever going to dip below a certain value and this is important for everybody.

Variety in Choice – Rather than being forced into one route, investing in gold leaves numerous options as we’ve already seen. Not only can you choose between coins, bullion, and different investment options, you also have opportunities depending on the stage of life you’re in. For example, leading up to retirement could be the time for security and switching to a gold IRA.

Affordable – Despite popular belief, gold is actually affordable and the many available solutions make the investment easier than ever before. As long as you find a trustworthy and reliable service, the whole process will be dealt with on your behalf and you can sit back while enjoying the benefits.

Conclusion

What is a gold investment? Hopefully, we’ve answered your questions here today! As long as you consider your own needs, gold can be a great investment so feel free to continue your research and talk to a finance professional today to find out more!

I hope you enjoyed this post and if you have any questions about gold investment or want to leave your own personal experience, leave a comment below.

Our personal recommendation to safeguard your future with gold is to contact Regal Assets, The #1 Rated Gold Investment Company 7 years in a row, Click Here To Request A FREE Gold Investors Kit.

Your recommendation to switch to a gold IRA when you get close to retirement in order to have more security is a good idea. If you want to do this, you’d probably want to research the various Gold IRA companies early on. Doing this could help you figure out which one you want to work with and ensure you’re able to plan everything out properly before making the switch.

Hi Tiffany, thank you for stopping by and taking the time to comment.

You may be interested to read the review we wrote earlier on the Best Gold IRA Companies