Gold Works…

Physical Gold has real world uses and is in demand, including being used in manufacturing nearly every sophisticated electronic device.

Gold cannot be manufactured…

When you invest in physical gold it is a safeguard against irresponsible governements…

Two Possible Outcomes:

1. Things Get Better

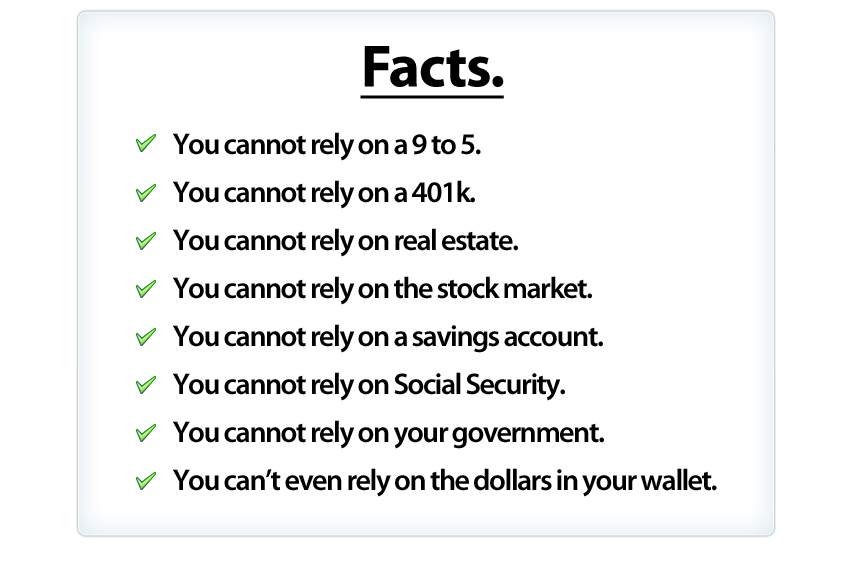

With unemployment exploding, foreclosures at an all time high, and Billion dollar companies failing, it’s reasonable for the average citizen to assume that things “can’t get any worse”.

That is dangerous thinking. Especially with a double-dip recession on the horizon.

But let’s say things do magically get better… what would that mean?

Would it be permanent? Not a chance

Even so, what would happen to gold if things magically “got better”?

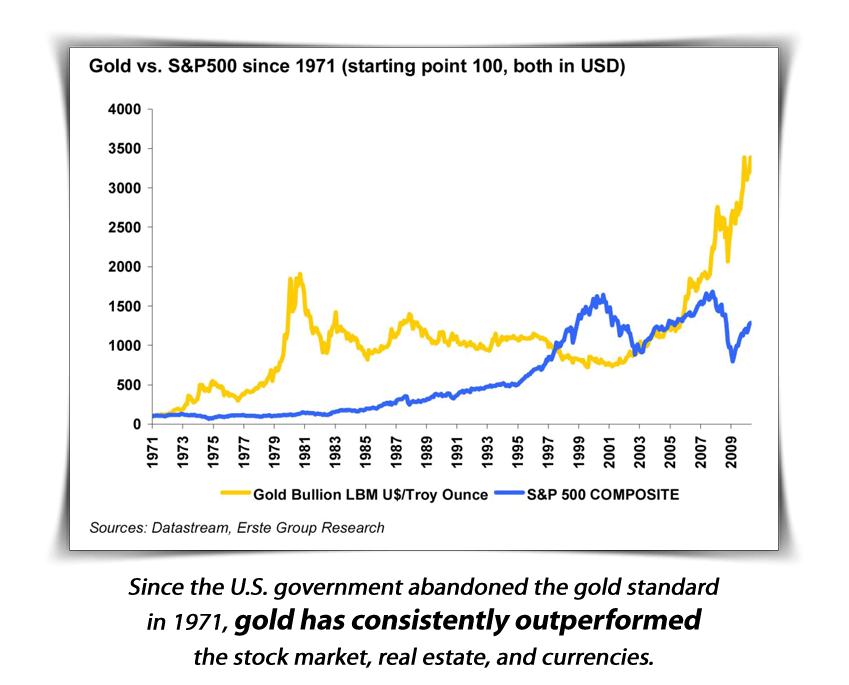

While gold has had ups and downs, and stagnation at times, the fact remains that since the U.S. Governement abandoned the gold standard in 1971, gold has consistently outperformed the stock market, real estate and currencies

2. Things Get Worse

2. Things Get Worse

A MUCH more likely outcome… things will get worse over the next few years

And that is GOOD for anyone who owns gold. Because when consumer confidence is low, and interest rates are low, demand for gold goes up.

Gold benefits from economic and psychlogical factors.

Meanwhile, the cost of simple litems like a loaf of bread will continue to rise to unprecedented prices, while average citizens continue to make the same amount of money they’ve been making.

What will happen to you and your family when your savings and retirement accounts are completely worthless?

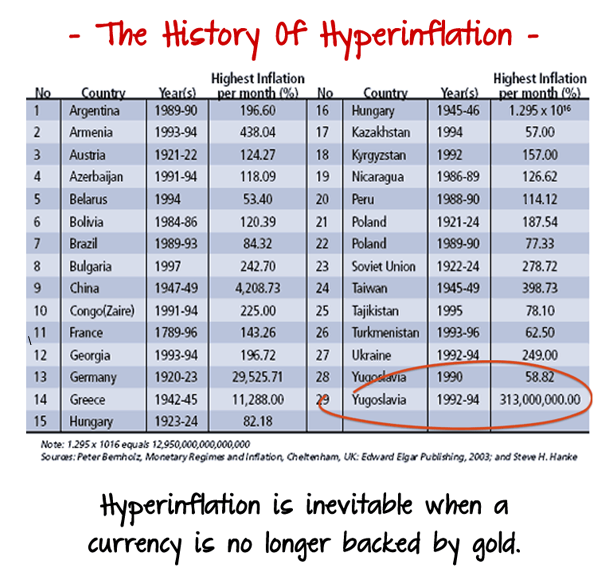

Currencies Fail.

Every single paper currency fails eventually.

Think about that for a second.

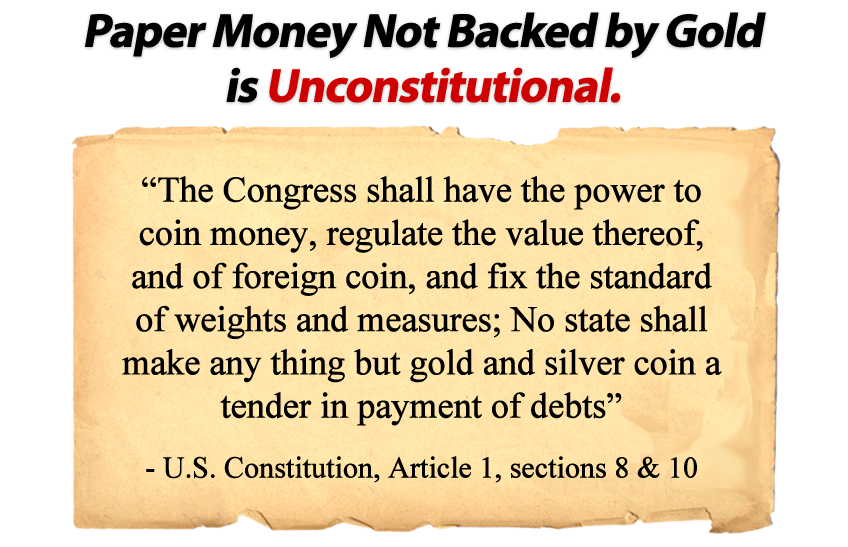

There is a reason that the founding fathers of America specifically mentioned gold and silver in the Constitution

A major factor that resulted in the American Revolution, and the subsequent independence from England, was that the American Colonists did not want any part of England’s central banking system.

Central Banking Does Not Work

A central bank is an insititution that usually issues the currency, regulates the money supply and controls the interest rates in a country. In contrast to a commercial bank, a central bank possesses a monoply on printing the national currency.

The central bank has never worked becasuse when you give a private bank, with private owners, free reign to control a country’s currency. Unfortunately, there are no checks and balances to stop those individuals from printing money irresponsibly or to advance their own interests.

It’s improtant to note, England’s requirement that Americans accept the Central Bank of England, was one of the very reasons that Americans fought for independence in the 1770’s.

And from that point until 1913, a few banking systems came and went, depending on who was in office. President Andrew jackson was very outspoken against central banking, and in 1835 he helped the U.S. Not only become debt free, but there was actually a $444,000 surplus

So what happened in the early 1900’s when Congress tried to introduce the idea of central banking yet again?

The public didn’t want any part of it.

So it was simply called a different name, “the Federal Reserve”, and the most powerful bankers in the world (JP Morgan and others) also guaranteed its approval by using their influence to create mass hysteria. They (falsely) announced that many major banks would soon be bankrupt and encouraged Americans to withdraw their money.

The “bank run” became a self-fulfilling prophecy, and the mass withdrawals DID, in fact, wipe out a lot of smaller banks.

After the big bankers had proven their point, even through manipulation, Congress had no trouble getting approval for the Federal Reserve – which they said would prevent any future hysteria or bank runs.

The Federal Reserve is a privately owned bank, outside U.S. jurisdiction, that can do whatever it wants. It prints money and loans it to the U.S. governement with interest.

Then in 1971, the U.S. Government decided to give the Federal Reserve the ability to print money without needing to have an equal amount of gold in the vaults to back it up. Up until that point, all U.S. dollars printed were required to be backed by an equal amount of gold.

So, every dollar printed since 1971 has been backed by thin air. And the national debt began it’s 3,381 % rise to $14 trillion dollars (UPDATE: 2017 US National Debt is MORE than $20 Trillion!)

Countries & Governments are Buying Gold

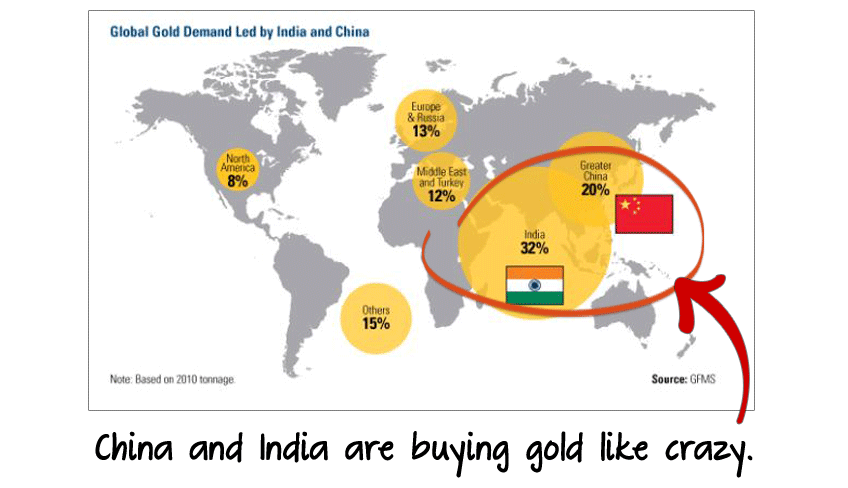

China and India are buying gold like crazy. They consumed 52% of the world’s gold in 2010. And in 2011, increases in demand from China and India have driven a 7.5 per cent increase in demand for gold jewelry during the first half of the year, despite a 25 per cent increase in the price.

Additionally, a recent cable was leaked by the infamous WilikLeaks website, which revealed the REAL reason behind China’s increasing demand… It showed that China’s intent is to make major gold purchases for the sole purpose of weakening the U.S. dollar.

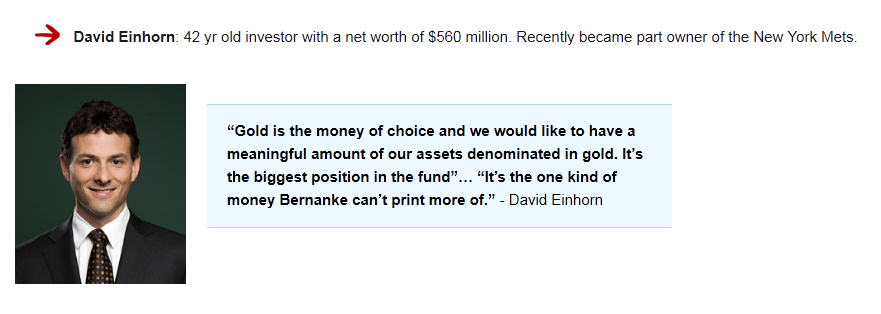

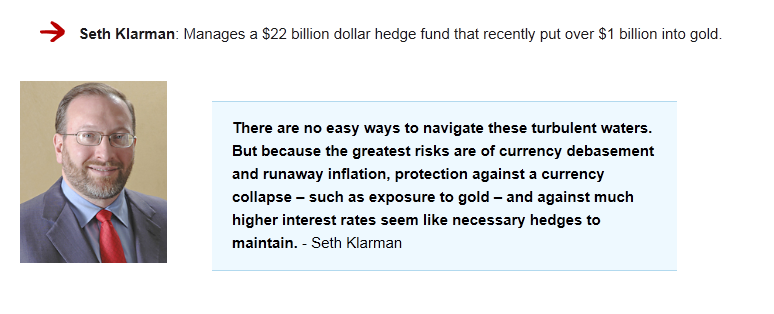

Billionaires are investing in Gold

Gold is RELIABLE

Watch This Video And Request Your FREE Gold Investment Kit

Our personal recommendation to safeguard your future with gold is to contact Regal Assets, The #1 Rated Gold Investment Company 7 years in a row, Click Here To Request A FREE Gold Investors Kit.