If you have been working in an organization for the past two years, it’s likely that you own a retirement savings account. While the majority of retirement savings accounts and investment portfolios are dominated by bonds, stocks, and other dollar-based assets, many people now consider holding a percentage of their investments in precious metals. This is because precious metals such as gold can help safeguard their wealth against inflation, sudden loss of value of paper money, and economic upheavals such as the catastrophic stock exchange collapses that occur about every ten years in the developed world.

If you own a retirement account, it makes sense to diversify your holdings across different investment options. However, traditional retirement plans such as the 401Ks and traditional IRAs are bound to the stocks market and offer little to no flexibility regarding investments. This is why Gold-backed IRAs or Self-directed IRAs are becoming more and more popular among retirement investors.

After all, the funds in your retirement account are supposed to help you live a comfortable life when you become old or financially independent enough to quit working.

Why Gold IRA Rollover?

Gold IRAs offer investors immense flexibility and powers to invest their funds in a wide range of holdings within and outside the stocks market.

As an owner of a Gold IRA account, you can invest in gold, silver, platinum, palladium, private equities, real estate, commodities, and many other investment options, as long as your custodian can administer the assets. While this provides ample opportunity to diversify your portfolio, it also presents some managerial challenges, which is why you need specialized custodians.

What Is A Gold IRA Rollover?

A rollover refers to movement of funds from a compatible retirement savings plan such as a 401k or classic IRA to a precious metal IRA. This means that you already have retirement savings account under the old plans such as the 401Ks and traditional or Roth IRAs, but now you want to move the funds in that account into a gold-backed IRA.

There are two methods for moving funds from one retirement account to another. One is a rollover, and the other is actually a transfer although many people also misconstrue it for a rollover. However, the rollover is more effective and safer than a transfer as it puts you in a tax-advantaged position and can even serve as a short-term loan from your retirement savings, as we will learn later in this article.

The distinction between a rollover and a transfer is that you will be paid the money you intend to move and then deposit the cash in the recipient account in a rollover. Whereas, a transfer involves a direct transfer of the funds from the old custodian to the new custodian without the money ever reaching your hands.

Gold Rollover

In a Gold IRA rollover, your custodian issues a check of the amount you are moving, and you are allowed 60 days from the date of issuance to deposit the funds in your chosen Gold IRA company or custodian. During that period, the funds are tax-exempt. However, the money becomes taxable after 60 days if you didn’t deposit it in the recipient account and you will also pay a 10 per cent penalty for early withdrawal before the IRA-stipulated age of 59 1/2.

During the 60 days, however, you can use the money for whatever you like, but make sure to deposit it before the time elapses. This is why the rollover is considered a form of a short-term loan from your retirement savings.

The terms of a rollover depend on the type of account from which you are moving funds. If the same tax rules apply to the accounts, for example, a classic 401k to traditional IRAs or Roth 401K to Roth IRA, you won’t pay taxes on the transaction. However, you will face tax issues if you are moving money between accounts with different tax rules such as a rollover from a Roth 401k to a Gold IRA. You can only perform one IRA in a year.

Gold IRA Transfer

In a transfer, your old custodian transfers the money directly to your new custodian, often through electronic transfer or check. There are no waiting periods, and you don’t get to see or touch the money.

Which Retirement Accounts Can Perform A Gold IRA Rollover?

Many traditional retirement plans qualify for a Gold IRA rollover including the traditional 401ks, 403B, 457B, Roth IRAs, traditional IRAs, Thrift Savings Plans, annuities, pension plans, among others. You can roll over funds from these accounts into a Gold IRA.

It’s important to add that 401ks and Roth IRAs have different sets of rules for rollovers and transfers. And some employers place restrictions on their retirement plans. Before you start the process of a Gold IRA rollover, you should ask your employer what is permitted under the terms of its 401K plan, or other retirement savings accounts it operates on your behalf.

Opening A Gold IRA Account

Before settling for any Gold-IRA provider, it’s important that you carry out due diligence. There are hundreds of  Gold IRA companies out there, and many of them are unscrupulous elements out to fleece you of your money, and you don’t want your retirement funds falling into the wrong hands.

Gold IRA companies out there, and many of them are unscrupulous elements out to fleece you of your money, and you don’t want your retirement funds falling into the wrong hands.

Check out their history, customer reviews, the look of their website, and the facilities they offer. While a gold-backed IRA offers more investment opportunities, your options are only as varied as what your Gold IRA company supports. You must check that the company you choose offers coverage for all the assets you intend to hold in your portfolio.

Also, you must remember that you can only perform one rollover per year. Should you find the terms of your chosen IRA provider unfavourable after the rollover, you may have to wait for another 12 months before you can rollover your funds to a new provider, except you are willing to pay the tax penalties that come with exceeding the minimum.

Once you have decided on a trustworthy Gold IRA custodian, you can go ahead and rollover your funds from the old retirement account. Your custodian will provide you with the paperwork you need to arrange the IRA rollover. It’s better to handle the paperwork well ahead of time so the rollover can be processed quickly and you can deposit the funds before the end of the IRS’s 60-day ultimatum.

Don’t forget to discuss the administration fees as these will be deducted from your retirement funds, and higher fees can make a significant dent on your account over time.

Perfect Your Gold IRA Investment Strategy

People invest in gold for several reasons, but you need to have a clear-cut strategy going forward. Most people invest in gold to diversify their wealth. If that’s the case, experts recommend allocating about 5-10 per cent of your total investment portfolio into precious metals.

If you fear that the paper currency might suffer catastrophic devaluations like that of the Great Depression, a safe strategy is to invest about 10-20 per cent of your retirement savings in gold and other precious metals.

However, if you want to profit from the fluctuations in the value of gold, it’s advisable not to invest more than 20 per cent of your portfolio in gold. This is because the gold market is highly volatile as well, and natural disasters, strikes, wars, and political turmoil can crash the prices. The rule of thumb is to play safe at all times. Take risks, but don’t get too confident.

Investments Allowed in a Gold IRA

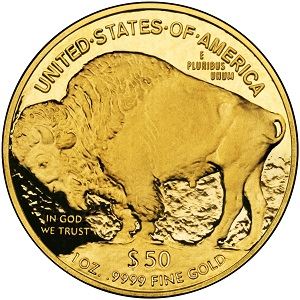

The IRS is strict about what can go into Gold IRAs. The IRS allows some select 24 karat gold coins except the 22 karat Eagle Coin.

You can buy American and selected foreign-made precious metals. You can also invest in gold-backed stocks as well as many other assets.

Whatever you choose to invest in, be sure to understand where you stand with the taxman to avoid any bitter experience.

Our personal recommendation to safeguard your future with gold is to contact Regal Assets, The #1 Rated Gold Investment Company 7 years in a row, Click Here To Request A FREE Gold Investors Kit.