If you have an IRA, you’ll know these are questionable times for everybody. With IRAs relying on the performance of the economy, it’s been almost a decade since the global financial crisis and the economy hasn’t exactly been stable or strong since. Despite many decades of strong economic performance, we suddenly feel vulnerable having our retirement funds tied to stocks and bonds.

However, this doesn’t have to be the case because many are now choosing to invest in gold instead. Whether you know somebody who has made the jump or you’ve seen the commercials on the TV, you might have heard about gold IRAs, (in case you haven’t heard this term check out What is Gold IRA about?), but why are they so popular?

What Is A Gold IRA?

Before assessing the benefits of gold IRA, we first need to know what the term means and what it means for the future of your finances. In truth, there are two main options because some IRAs will allow you to include gold within your IRA plan. If your plan allows for this, it might be worth having a discussion with your provider and we’re going to assess why today. If this isn’t possible, the other option is to transfer or rollover your exiting IRA into a gold IRA.

Although gold is the primary asset in this retirement account, you may also have an opportunity to choose silver, platinum, and other precious metals but this depends on the custodian. Despite being an option since Bill Clinton made them well-known towards the end of the 1990s, gold IRAs only recently started to see interest due to the position of many global economies.

After choosing a custodian, they’ll normally do everything on your behalf and it’ll all be done in accordance with IRS guidelines. Rather than relying on the economy performing to add value to your retirement account, you suddenly remove this need (and the insecurity that comes with it). Instead, you’ll be looking at the value of precious metals alone and these are less susceptible to changes in the economy. In fact, a downturn can actually make your retirement account more valuable because everybody suddenly wants a piece of the action.

Benefits Of Gold IRA

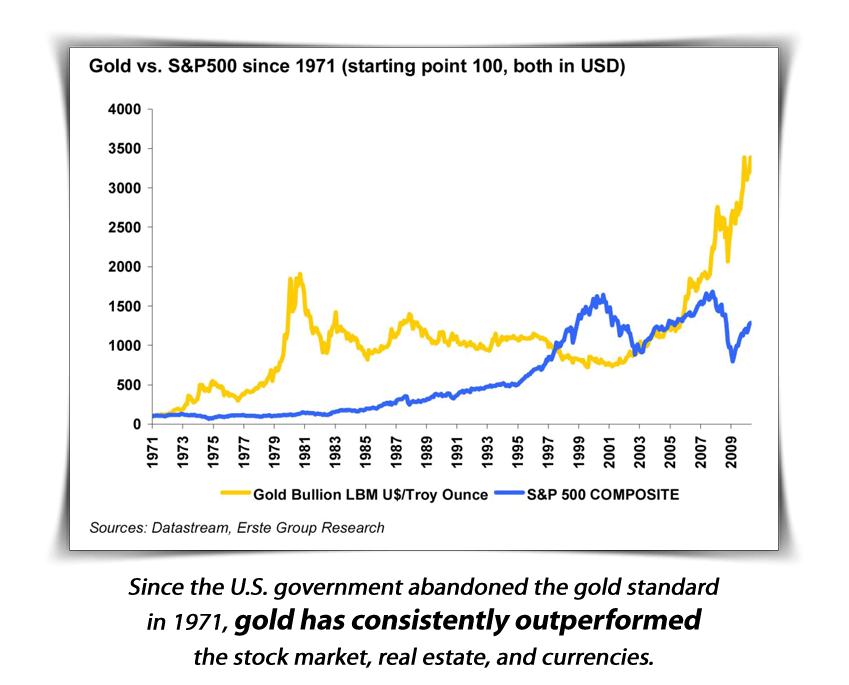

Stability – When researching this topic and looking for the benefits of gold IRA, it’s hard to look past the fact that gold is stable. While stocks, bonds, and mutual funds can fluctuate with no floor to protect their value, gold will always have a minimum value. Known as a ‘safe haven’ asset, you only have to look back through history to see how gold has performed. Even when the economy is struggling, gold has always steadily risen in value. Even when it has dropped slightly, it never goes too far because the demand for gold is ALWAYS in place.

In the unpredictable world in which we reside these days, security could be exactly what you need. As you head towards retirement, the last thing you want after building funds for decades is a collapse of the economy. According to the associated figures, IRAs and 401(k)s lost nearly $2.5 trillion in just TWO QUARTERS in the second half of 2008. For the average worker with 20 years in their job, one estimate suggested a 25% decrease in IRA value. Even today, we’re paying for this collapse and there’s nothing to say it won’t happen again.

With these numbers in mind, gold suddenly looks more attractive and we don’t blame you for coming to this conclusion.

Positive Historical Returns – When comparing performance-related assets and gold, there’s certainly a ‘risk v reward’ and this is something we all have to consider. In a good year, stocks and bonds can outperform gold dramatically. However, gold has a strong growth rate if we assess the long-term. For example, between 2005 and 2015, its average growth rate went over 5.70% higher than US treasuries which are generally considered to be the ‘safe’ option.

Diversification – If you have money in real estate and various other investments like this, every single cent you have invested is reliant upon the economy. Even though you’re diversifying from IRA to real estate, you aren’t diversifying from what they require to excel. If you really want to diversify, having money in gold and precious metals is the way to go because they don’t rely on the same performance factors. Since gold doesn’t move in the same direction as the stock prices in the US, you have a cushion when stock market corrections occur.

Tax Advantages – Over the years, we’ve seen several myths regarding gold IRAs and one of them suggests they don’t provide the same tax advantages. However, this is false because you can still enjoy the same tax benefits regardless of whether you have a conventional IRA or a precious metal IRA and this is one of the benefits of gold IRA. Even if you sell gold within the IRA and make a profit, no tax will come into play until the money is distributed.

Consistent Value – Although we touched on this previously, we just want to continue the point of gold always having value. If we look back hundreds of years to when Britain first invented the gold currency system in the 11th century, gold has always had value so you can be certain this will stay true over your lifetime.

If we take a look at the periodic table, we can obviously eliminate the liquids and gases since we can’t create a currency from these. For copper, iron, and lead, they’re prone to corrosion which is an issue when creating coins and currency. When trying to encourage value and security, aluminium is a little light while palladium and platinum are so rare the coins couldn’t possibly spread between enough people (although they are reasonable choices). With metals, they need to be rare enough that they can’t be obtained freely while also having enough to circulate.

After eliminating these, we have just silver and gold left. For gold, it won’t corrode, the atoms are heavier than most, it offers a unique color, and it absorbs some light as the electrons move faster. With this in mind, and assessing many other factors, there’s always demand for gold and it’ll always retain value.

More Freedom – Finally, and this is especially true with a self-directed IRA, you can act when the price of gold fluctuates. If the price dips a little, this is the perfect time to add more gold to your retirement fund. Over time, the price will recover and stay on the general path upwards and you can enjoy the money you just earned in a quick space of time.

Conclusion

If you’re going to invest in a gold IRA, now is the time to do so and you can enjoy everything we’ve discussed here today. With these benefits of gold IRA, your retirement fund is protected, you don’t have to worry about stocks falling through the floor, you have the freedom to make adjustments, and the tax advantages are just the same as every other IRA!

I hope you enjoyed this post and if you have any questions about the Benefits of Gold IRA or want to leave your own personal experience, leave a comment below.

Our personal recommendation to safeguard your future with gold is to contact Regal Assets, The #1 Rated Gold Investment Company 7 years in a row, Click Here To Request A FREE Gold Investors Kit.