In recent months, you might have been reading and hearing lots about the opportunity to invest in gold but this probably leaves you with more questions than answers. If so, don’t fear because we have a guide to investing in gold today. Not only are we going to explain why everybody seems to be including gold in their portfolio now, we’re also going to explore some of your options.

Why Invest in Gold?

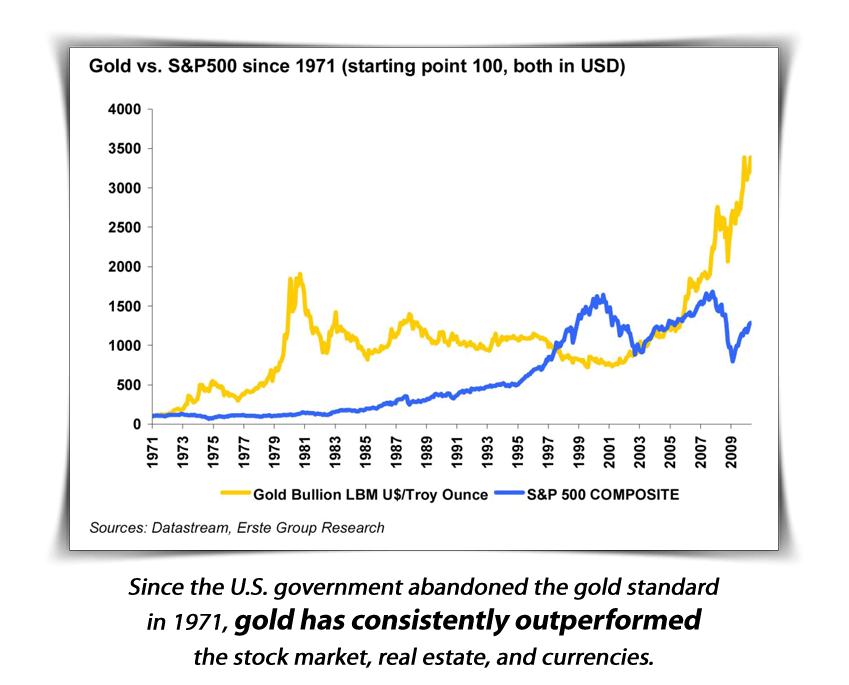

How could we possibly provide a guide to investing in gold without first explaining the trend? Well, let’s not forget that this isn’t exactly a new craze. Ever since the dawn of man and the discovery of gold, it has held value and this value has steadily increased ever since. Therefore, we aren’t bringing you a new idea but it has certainly grown more popular in the last decade. Read the article “Why Invest In Physical Gold”

For those of you good with mathematics, you’ll know a decade brings us to just before the global crisis of 2008/09. During this time, the US, the UK, and many other countries recognized that the economy of each country isn’t quite as strong as we first thought. In the US, for example, we’ve long-been proud of the Dollar and its performance on a global scale. By definition, it has been the second-strongest currency in the world; only the British Pound has retained a higher value over the decades.

Suddenly, the economic crisis occurred and the whole world was shocked. Within a matter of weeks and months, millions lost money on the stock market but the collapse actually went deeper and attacked pensions, savings, and all sorts of other funds.

Although the global economic crisis isn’t the main reason behind the increase in demand for gold – we could also thank the internet since this has enabled information to be shared more easily – it certainly plays a role. Today, gold is seen as the ideal investment for numerous reasons;

The price of gold isn’t directly linked to the performance of the economy, interest rates, our currency, or any other external factor.

- Gold is extremely easy to buy/sell on a global scale.

- It has a strong historical performance and has retained its value over hundreds of years.

- The price of gold has been increasing for many years and, although there are fluctuations in the short-term, it’s a much more reliable long-term investment than stocks and shares.

- While cash and property can both be destroyed, gold is indestructible and therefore reliable for many years to come.

- Finally, the price of gold actually increases when the economy is struggling because the demand suddenly increases; this gives you an opportunity to make money.

Why Does Gold Have Value?

Before we take this guide to invest in gold in the actual investment side of things, we should first note why it retains value because people are often suspicious. Ultimately, gold is (always has been and always will be) finite which means it can’t be created in a factory (like money is printed). Still today, gold is relatively rare and, thanks to the theory of supply and demand, we know that commodities in short supply generate a more generous asking price.

All things considered, this means your portfolio becomes less volatile and more reliable in the long run. If the economy takes a turn for the worse again, a certain percentage of your money will be safe because the price of gold won’t be impacted. Even as currency values swing one way to the next, you’ll be secure through economic uncertainty and this is the best way to have real peace of mind.

Investing In Gold

Since this is a guide to investing in gold, we should also explain your options because there may be more than you first thought. Often, the idea of investing in gold brings images of owning some precious metals locked away in a faraway vault. However, the option you choose will completely depend on your financial position and long-term strategy.

Gold ETFs – Of all the available ETFs, there are thought to be around 33 that invest in gold. For example, the largest is GLD and it offers an expense ratio of 0.4%. Meanwhile, you could also choose AGOL or DUST which are also centred around gold. Over the past seven years alone, the number of gold ETFs has doubled due to the increase in demand so you certainly wouldn’t be alone with this investment opportunity. With this option, in particular, the liquidity of your investment is important.

Gold Coins – Each year, US Mint distributes hundreds of thousands of the American Eagle gold coin because it provides us with an opportunity to own physical gold. When investing in this precious metal, many of us like to get our hands on the actual gold since we’ve had years of investing in intangible stocks. So long as you choose a reliable coin dealer, bank, or brokerage company, you’ll have your hands on gold coins in no time.

Gold Coins – Each year, US Mint distributes hundreds of thousands of the American Eagle gold coin because it provides us with an opportunity to own physical gold. When investing in this precious metal, many of us like to get our hands on the actual gold since we’ve had years of investing in intangible stocks. So long as you choose a reliable coin dealer, bank, or brokerage company, you’ll have your hands on gold coins in no time.

Gold Bullion – Alternatively, gold bullion (bars) is essentially the same but the company normally keeps a hold of the physical gold within a vault. One of the reasons we wanted to provide a guide to investing in gold was because of the sheer number of misconceptions; for example, the ‘fact’ that bullion is expensive. Today, we live in very different times and you can buy smaller amounts of gold to fit in with your portfolio and investment strategy.

Gold Jewelry – Across the US and the globe, jewelry remains as the most popular way to invest in gold but we must state that it should be seen as jewelry first and foremost rather than an investment. Rather than the gold content deciding the price, jewelry is more affected by the quality and condition as well as the rarity of the necklace, bracelet, or whatever it may be.

Gold Jewelry – Across the US and the globe, jewelry remains as the most popular way to invest in gold but we must state that it should be seen as jewelry first and foremost rather than an investment. Rather than the gold content deciding the price, jewelry is more affected by the quality and condition as well as the rarity of the necklace, bracelet, or whatever it may be.

Gold 401k Rollover – Finally, we want to finish on a solution not many know to exist. During the global crisis nearly a decade ago, millions of people lost their important retirement money because the currency lost value and the economy reached a state not seen for many years. However, these people could have been protected with a Gold IRA.

Once you rollover your traditional IRA to a gold IRA, you’re instantly protected against what might happen to the economy in the future. These days, the process is easier than ever before and you can get started with a simple visit to the Regal Assets website. From now until retirement, your funds stay safe and you can secure a financially stable future for both yourself and any family members.

Summary

Ultimately, as you’ve seen in ‘a guide to investing in gold’ today, there are numerous ways to invest in the precious metal and the route you choose will depend on your position in life. If you need help, feel free to talk to professional finance experts and they should be able to advise on your portfolio. Also, feel free to check out Regal Assets since we provide reading material so you can make the best decision for your future!

I hope you enjoyed this post and if you have any questions about investing in gold or want to leave your own personal experience, leave a comment below.

Our personal recommendation to safeguard your future with gold is to contact Regal Assets, The #1 Rated Gold Investment Company 7 years in a row, Click Here To Request A FREE Gold Investors Kit.